by David Siegel – writing at Decentralstation.com

In 2009, I wrote a book called Pull, on how things would be different once everything is online and interconnected. That vision is finally coming to life.

This short essay is my attempt to describe the fast-moving world of decentralization: blockchains, cryptocurrency, triple ledgers, distributed apps, and more. Here is the one-minute summary:

This short essay is my attempt to describe the fast-moving world of decentralization: blockchains, cryptocurrency, triple ledgers, distributed apps, and more. Here is the one-minute summary:

Blockchain technology is a shared ledger that everyone trusts to be accurate and permanent.

By sharing a single reliable database, we can:

Eliminate trillions of dollars of wasted effort in coordination, market functions, and clearing.

Record data – including ownership rights to anything of value – permanently, in a way that can’t be hacked or stolen.

Eliminate middle men – companies that bring buyers and sellers together and charge high fees (everything from banks to insurance companies to ecommerce to Uber)

Eliminate data centers, which are targets for hackers.

Eliminate IT departments, which are expensive, sluggish, and prevent companies from being agile.

Radically transform government services to be far cheaper, faster, and better.

In addition, we can now add programming to blockchain-based assets, which makes them programmable and “smart.” We are actively creating new data ecosystems that allow many real-time innovations, from remote surgery to fleets of drones to programmable music rights to tracking blood diamonds and minerals. While it’s still in its infancy, blockchain technology has tremendous promise. Our estimate is that by 2030, more than $10 trillion and possibly as much as $20 trillion of world GDP will be on the blockchain.

To unpack this, I’m going to start using eBay as an example.

Decentralizing eBay

Today, eBay is a public company with 165 million active users, 35,000 employees, $18 billion in revenues and net income of $530 million. Around the world, eBay owns and operates huge buildings full of servers — to make sure all the information is backed up and available. If any one data center is attacked or destroyed, the other locations will take the load.

eBay is a centralized system with its own infrastructure, controlled by its executives. It’s expensive and profitable: by the time you get paid, you’ll lose about 10% of the price to the various intermediaries in the eBay ecosystem. It’s also vulnerable: it can be hacked, not least by its own employees, and credit card numbers and account information can be stolen.

There’s another way to build that system now. In a decentralized system, we could design an application similar to eBay that doesn’t use central servers and control. We could store data on anyone’s computer who wants to store it. These aren’t volunteers — we pay them a few cents for their computing power. At the scale of eBay, there would be tens of thousands of such computers, and all of them store a full copy of the system, creating massive redundancy. Since thousands of computers have a copy, no “bad actors” can disrupt it.

This is what the blockchain does. A blockchain records an encrypted, permanent record of every transaction; hardware+software nodes on the network called “miners” verify and store that information for a small price. This creates a distributed system that expands as necessary and can’t be hacked.

Ethereum

Ethereum, which was first described in a white paper in 2013, is the operating system that adds programming to blockchains, effectively turning the network of “miners” into the world’s largest computer.

Ethereum can be programmed just like any general-purpose computer, and apps built on Ethereum can grow to any size, are incredibly secure, preserve anonymity, are auditable, and provide the same service at the same scale for less than 1% of the centralized price.

We can now do everything eBay does with a fraction of the people, no hardware, secure payments, and at least 90 percent cheaper. Decentralized marketplaces are already fully functional and growing fast.

While blockchains manage transactions (think of blockchains as ledgers), we’ll use a similar scheme to store our content (web sites, images, videos, etc.) and pay for computing power from tens of thousands of people who offer these services.

Some of them will be in huge data centers, others will be in people’s basements — it won’t matter. Systems will expand and contract easily, and payments may be made in microseconds, seconds, or minutes – depending on the system. Your encrypted data will go onto thousands of verified servers, so it can’t be destroyed.

An Ethereum “node” is a computer willing to offer the entire suite of services Ethereum provides as a service. These nodes will provide storage, processing power, and transactions on the blockchain.

eBay on Ethereum

If you forget marketing and customer service, a system that scales securely to the size of eBay could be created in a few months by a small team and left online as open-source software with no extra charges at all. It wouldn’t have to be a company or have any employees. It would cost just a few pennies to list anything, from a matchbook to a car. It could rely on community-based methods of policing, reputation, arbitration, and resolving problems.

Think about that. If this kind of service took off, something on the order of $200 billion in annual recurring revenues from eBay, Craigslist, job boards, and other classified systems would be reduced to … almost zero. The only real cost would be for the “miners” who provide storage and processing power for pennies.

Is that really possible, you ask? It’s already been built.

Smart Contracts

Because Ethereum has its own currency, it lets us write smart contracts. You program business logic into a smart contract and let it execute automatically. Now the system will make sure that only allowed actions can take place, whether it’s escrow, payment for services, scheduling an appointment, heating a building, landing an airplane, checking out at the grocery store, harvesting potatoes, etc. Renting or using a shared car in the future will involve no human contact. No need to check in at the hotel – just go straight to your room. Software makes most of the decisions using sensors and event-driven data feeds as input.

Definition for business people:

A smart contract is software that runs on every computer in the Ethereum network. It is unambiguous, can transfer asset ownership, and the results are recorded by all nodes in the network. It may be made up of subcontracts and have unknown dependencies. It cannot be revoked except according to predetermined conditions.

The software will execute as written regardless of any legal frameworks.

Because smart contracts are networked code, they are not private. In most cases, this is a good thing. Groups are working on creating libraries of code/contract modules that will form an active “smart” infrastructure that eventually will tie into smart legislation and existing legal frameworks worldwide.

Let’s say you want to deposit some money and have it earn interest. You would use a smart contract to specify exactly what you want, and enter it into a peer-to-peer lending ecosystem. If someone is willing to give you the terms you are looking for, they would accept your offer and begin a smart contract. Or, you could look at the offers and accept one. The person on the other side could be one, or even several people, or an institution, but there’s no “bank” in the middle, no escrow service, no set-up fees, and no recurring fees. The smart contract handles 100% of the execution.

Imagine setting up a decentralized poker game. You would program it in some popular programming language and run it on the Ethereum platform to manage schedules, poker tables, tournaments, deal hands, etc. Each bet would be a smart contract, and at the end of each hand, the money would transfer automatically from person to person — not to the house and then back out. Both the house and the mining community would get their cut – a far smaller cut than a normal poker site would charge.

Imagine a group of people who come together and make a movie, or a band, or a company. They can create a smart contract that says who will be paid royalties under what conditions, and then the incoming money flows are automatically routed to each recipient.

Think of it as programmable money – we couldn’t have smart contracts before, because there was no automated way to settle. Permanent, reliable, fast, automatic settlement will be a game changer, not just for how we use money but for how we use people.

The Decentralized Stack

Ethereum is the new operating system of the Internet. Here are the parts so far:

Bitcoin: A cryptocurrency whose central mechanism, the blockchain, is being used for other purposes.

Blockchain: A permanent, time-stamped record of encrypted transactions & data.

Ethereum: An open-source virtual machine that allows programmers to build dapps using blockchain. Includes ETH, its own native currency.

Smart contracts: Business logic encoded to run on Ethereum blockchain, using new contract-building languages that are similar to existing programming languages.

Dapps: Distributed apps – applications that use blockchain storage and computing power through Ethereum. Generally, dapps look and feel like existing apps you know and use every day.

Tokens: There are already many tokens to represent value inside various systems. There will be many more, and some of these tokens will bridge systems to make them interoperable.

Miners and Nodes: Machines that store blocks, maintain the chain, and provide storage and computing power.

Gas: The small amount of money you pay for each transaction that rewards nodes for providing their services.

Decentralized storage: Lets us store as much content “off chain” as we like on computers around the world and pay a small fraction of what we would pay Dropbox or Amazon.

Decentralized processing: Similar to “Folding at Home” and other large-scale processing projects, we will use thousands of small computers to do supercomputing “off chain” and pay each one a bit of gas for the service.

Extras: There will be plenty of APIs, gateways, exchanges, security, authentication, and other decentralized services to facilitate communication between ecosystems, especially for highly regulated industries and products.

Web 3.0 browsers: New browsers are being built that help you manage your cryptocurrency, keys, passwords, blockchain, identity, permissions, etc. In general, they will use the familiar web front-end toolkits: JavaScript, AJAX, HTML, etc.

Features of this new stack:

Robust: Ethereum runs redundantly on thousands of machines with no off-switch, no central control, and no chance to destroy the network. Unlike other networks and systems, the Ethereum network can’t go “down” any more than the Internet can.

Trustless: There is no third party in the middle to manage the transaction, and you don’t have to trust the miners who do this work for you – you pay a bit of gas for each transaction and every miner gets a copy of your record in the blockchain. High redundancy and confirmations ensure that bad actors can’t steal your money.

Cheaper: It takes far fewer people to write distributed applications and smart contracts than it does to build and maintain infrastructure. There is far less to maintain, and most of the details are handled in software.

Latency: It can take up to ten minutes to confirm a transaction and have it replicated on thousands of computers managing the blockchain. This is by design. It’s meant to ensure that the cryptography can’t be hacked by super-fast machines. Many companies are working to add “sidechains,” tokens, and other software to reduce confirmation time, which is essential for certain markets.

Scalability: The system scales out efficiently, since millions of people paying a bit of gas is a strong incentive for thousands of miners to provide services. The more transactions, the larger and more efficient this market gets.

Throughput: The goal is to upgrade this trustless system to process tens or even hundreds of thousands of transactions per second, at the level of today’s large-scale proprietary systems, like Visa and SWIFT. We are not there yet. Even though security is built into the system at the lowest level, time scalability will be a challenge as more people want to use dapps. Many people are currently working on this problem, with different types of solutions for different needs.

The Pay-as-You-Go Economy

It helps to understand that a decentralized economy is a pay-as-you-go economy, with smart contracts transferring cryptocurrencies at each step. So if you want to store your video collection, you’ll have to pay the market to store, serve, and possibly maintain it.

This is the gas payment, and it’s why many of the new services come with their own “coin” (currency), so you can pay for what you use.

One way to do this is to use tokens. Think of tokens as poker chips: you exchange some cash for tokens, you use the tokens in the system, then later you can cash any remaining tokens back out.

Tokens are used in a single system, like airline miles, phone minutes, or “points” in games. They’re a way of keeping score within a single system.

At the moment, people are inventing digital tokens to do all kinds of jobs. For example, the Internet of Things is likely to use tokens rather than currency to manage billions of sensors and devices.

A smaller system, like Filecoin, is trying to create their own currency for storing data, and we’ll see whether the market wants another currency for that, or whether Filecoin will have to become more of a token.

Some tokens carry intrinsic value – if you lose them you lose money – while others are just for keeping score.

You wouldn’t want to learn that your poker chips have lost value in the last hour because the market for them has changed. So tokens are going to play an important role in decentralized ecosystems. In some cases, like Ethereum and DASH, the token is also the currency and can be traded openly.

There is clearly a need for cryptocurrencies (and tokens) that are directly pegged to international currencies (Dollars, Euros, Reminbi, Yen), precious metals, and possibly other stores of value, like diamonds.

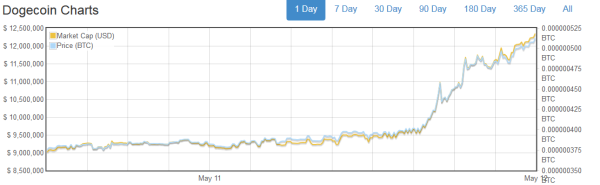

At the moment, we’re seeing several races to see which coins/currencies will become valuable and which will be forgotten or subsumed. Within a few years, those races should settle out – which coins and tokens will win is anyone’s guess.

The pay-as-you-go economy will have huge implications for the way we do accounting. In general, smart contracts will settle immediately, getting rid of most short-term credit, payables, and receivables.

We will have to invent new ways of trusting, exchanging, returning, and providing warranties for goods and services traded with smart contracts and no 800-number to call in case something goes wrong.

In the coming years, entire departments could be wiped out as transactions handle their own record keeping and reports generate themselves.

More Use Cases

Let’s say you invent something or write a song or a movie script. For a few pennies, you can put a special code into the blockchain that references your creation and locks in the date forever, allowing you to show definitively what you created on that date. This leads to various digital notary and validation services, most of which will be automated.

Much more is coming. Each year, people remit over $500 billion in transfers from person to person using systems that charge outrageous fees from bank to bank.

Blockchain and cryptocurrency will transfer all that value from wallet to wallet at close to zero cost.

The list of businesses that are about to be disrupted is very long. It’s the list of ecommerce companies, banks, lending institutions, insurance companies, registrations, tickets, online markets, and other gated communities.

This technology is already reshaping government. Imagine a robust voting system for everyone on the planet, systems for reducing government paperwork by 90%, automatically paying your taxes as you buy things, a smart energy grid, contracts for connecting budgets to income, auctions that can’t be gamed, incredibly low commission stock markets, a bond market that operates with almost no human intervention, and smart, machine-readable laws that feed into an ecosystem of smart contracts, and more.

Managing records can be done with no storage infrastructure and few clerks. Creating and selling bonds will be done without investment bankers.

The cost of enforcing regulations will come down dramatically, as we regulate the markets themselves, rather than the people who run them. These are the burgeoning areas of cryptolaw and cryptolegislation – both very exciting areas to watch in the next few years.

Decentralized systems are already showing huge advantages in managing the Internet of Things, where billions of autonomous sensors and devices create mesh networks of measurements, decisions, and actions, with no central point of control or failure.

Much of this will run by itself, operating and monitoring systems that control everything from aircraft to heat and light and appliances.

Buildings and traffic systems will automatically adjust to the weather forecast and other data. Farms will water and harvest using data, and will buy their own insurance as necessary.

You’ll be able to rent any number of cars sitting on the street, simply by putting out a request.

Factories will automatically order their own supplies and time output to projected demand. Oil wells will respond to market price. Robots will talk to the things they are manipulating.

The blockchain and smart contracts will enable agility and progress at a pace most people can’t imagine today.

Soon, we will harness the power of expert systems and crowd forecasting to power smart contracts.

There are already several blockchain-based prediction markets, where you can bet on various future outcomes. This lets us plug dynamic forecasts into decision making and execution.

Here’s an example from the world of market monetarism: Instead of forecasting inflation, unemployment, and GDP (and usually doing the wrong thing), the Fed could create a smart contract for managing the money supply.

By creating a blockchain-driven NGDP futures market, the Fed could use current market expectations of NGDP to automatically manage interest rates, interest on reserves, reserve requirements, bond purchase programs, and more.

This does away with the Fed chairman carrying briefcases, sending wacky signals to the markets, and making bad calls on interest rates that send the economy lurching this way and that.

Everyone can count on the smart contract to execute with full transparency. People at the University College of London are busy designing a central-banking coin that any government can use to build their own contract-based systems for monetary policy.

Any company will be able to write smart contracts to connect their business logic to the machinery of payments and the ecosystems they serve.

People are already building decentralized systems for setting up, governing, and managing organizations, from nonprofits to large corporations. Smart contracts and probabilistic reasoning will do a far better job than humans for tasks we haven’t even invented yet.

e-Governance

This whole smart-contract thing has gone further than you may have imagined.

People are designing and creating organizations using smart contracts to manage the structure, decision-making machinery, and payoffs.

In a decentralized autonomous organization (DAO), there aren’t any directors or officers – the software handles these roles and allows for people to participate according to the rules. This includes equity, dividends, payments, tax issues, etc.

One goal is to create meritocracies, where people are rewarded with small bits of equity as they contribute, and can even lose that equity as the rules dictate.

In many of these scenarios, the corporation or organization exists fundamentally as software, with people playing the software’s game according to the software’s rules. This is no different from the way Bitcoin is managed today.

One group, BitNation, has already launched a blockchain-based constitution (you can create your own virtual country and sign up your citizens), a blockchain-based passport, and more.

We will see cryptocurrency designers and constitution consultants as this movement ramps up.

Vitalik Buterin, the originator of Ethereum, has written an excellent overview of these new decentralized organizations I highly recommend. A DAO crowdsale is taking place now (Feb/Mar 2016) at Digix. You will hear the term DAO in the future – be prepared!

The Energy Problem

The blockchain is a brilliant solution to the problem of expensive, unsafe intermediaries and bad actors, but it is not without its costs.

The Bitcoin system today requires around 250 megawatts to run – the power required to run about 20,000 average American homes.

This energy powers “mining” machines around the world (mostly in China, where energy costs are artificially low) doing calculations, called proof of work, that will all be thrown away after each block is confirmed on the chain. Clearly, this isn’t going to scale to fulfill the vision of decentralized computing for everyone.

On the other hand, centralized electronic money (banks, Visa, SWIFT, etc) isn’t exactly green, either. Today, data centers in the US consume more than 17 gigawatts. Google alone uses over 2 gigawatts worldwide. A gigawatt is the amount of energy used by a city the size of San Francisco.

Computer scientists around the world are working on an alternative method to keep the blockchain running without any trusted intermediaries. This approach is called proof of stake, which we hope will provide the same security and trustless transactions, without the huge energy costs.

The switch to proof of stake will change the ecosystem and the economics. Several companies are already trying various approaches, but so far the jury is still out on how the problem will be solved.

As this world expands, we expect practical solutions to emerge. Eventually, we hope Ethereum and other decentralized systems will be overwhelmingly less expensive and more energy efficient than centralized servers.

Risks

Are there risks to a system that has strong cryptography, redundancy, permanent unalterable records, and trustless ownership at its core? Yes, but we probably don’t know what they are.

While most of today’s databases add cryptosecurity on top, the blockchain starts with every single entry encrypted into the ledger using encryption so strong it can’t be guessed. This is a very different approach. There are no vast lists of credit card numbers or bank accounts.

Bad actors have to try to trick people into giving their passwords, and they can only get so many of those. The system doesn’t have the passwords, so it can’t give them up. In contrast, today’s data centers disgorge their contents like a free buffet once you crack the back door open. The risks of not decentralizing are probably far higher.

It’s not for Everything

Ethereum may be a “general purpose world computer,” but it isn’t going to replace your email system or word processor any time soon.

Ethereum is generally best for applications where …

There is a financial interest – cash or assets are being managed or trading hands.

There are many actors, who don’t trust each other.

There are dependencies, creating an ecosystem of conditions under which money transfers.

People prefer to set their own rules, rather than conforming to the rules of institutions.

Saving money and ease of use are valued over speed.

These requirements will change as the blockchain world evolves, but for now most companies are doing experiments and getting familiar with blockchain apps. Building a business case takes the kind of expertise only a few people have today.

Business people have to become more familiar with the opportunities and work closely with practitioners to find viable opportunities. Simply “sprinkling blockchain dust” onto existing applications is a helpful exercise, but it probably doesn’t solve any customer’s problems.

The Next Phase

Every new leap forward starts by imitating old solutions with the new technology.

Today, the reasons to recreate existing systems using Ethereum are cost and security. But that’s just the beginning.

I haven’t mentioned Facebook yet, because I hope we never have a social network on the blockchain. We can do better than that.

We’ll see Web 3.0 when we start to build ecosystems of interoperability and commerce.

Using blockchains and cryptocurrencies, we can now build a scalable market site like eBay at a fraction of the cost, but still we have to get buyers and sellers to come to it. And there could be dozens of similar projects, so if you want to sell a used iPad you may need to look at all those different sites, get accounts, and coordinate your listings and bids. To the end user, it won’t look much different from eBay today, but it will be safer and cheaper.

Next, we will use all these new tools to turn the tables on the model: rather than building social networks similar to those we know today, we could let each person build a personal data locker.

The personal data locker is a fully secure way for people to store and control their own data, including all their relationships, news, photos, resumes, legal contracts, and much more. This is what my book, Pull, was about, and we finally have the technology to build it. Please watch this short video:

To me, this is the promise of Web 3.0 — when we break down the silos and each set up our own personal “node” in the network, the ecosystems that flourish will become the basis for a new kind of borderless society.

We’ve been trapped by apps, web sites, vendors, and marketplaces for so long we don’t yet have a view to the possibilities. Once the decentralized model “crosses the chasm” to mainstream adoption, we will have a chance to create new, exciting opportunities we haven’t even begun to imagine.

Summary

There are alternatives to Ethereum. Think of these as operating systems – we may end up with several flavors, with different systems having different strengths and weaknesses.

Tokens and sidechains will help bridge several gaps. Eventually, ecosystems will sprout and we could easily use different systems in different ways seamlessly. We’re still working most of this out.

These new operating systems will likely change our society more than the Web itself has.

At the same time as we will be able to provide affordable world-class computing resources to every person on earth for pennies, we may witness a dramatic reduction in the size of the white-collar workforce.

The development of Ethereum has made Ray Kurzweil’s singularity event much more possible, and probably safer, than I would have thought a couple of years ago. It is a world I have been envisioning for 15 years.

The “world computer” has been born. It is just waking up.

by David Siegel – writing at Decentralisation.com

Segregated Witness or SegWit was originally supposed to be meant for Bitcoin, however, that did not go through and has now been given a chance to come good on Litecoin.

Segregated Witness or SegWit was originally supposed to be meant for Bitcoin, however, that did not go through and has now been given a chance to come good on Litecoin.